Please visit the Xcalibra website and Sign in to your account.

If you do not have any cryptocurrency or fiat on your account, please make a deposit.

Select the market on the left side of the screen, for example: SFX/BTC.

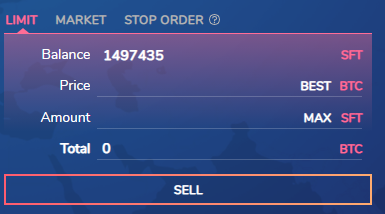

If you want to sell SFX go to the sell side where you can choose one of three options for selling: LIMIT, MARKET, and STOP ORDER.

1. Limit Sell Order

A limit order is an order that you place on the order book with a specific limit price. The limit price is determined by you. When you place a limit order, the trade will only be executed if the market price reaches your limit price (or better). Therefore, you may use limit orders to sell at a higher price than the current market price.

Unlike market orders, where trades are executed instantly at the current market price, limit orders are placed on the order book and are not executed immediately, meaning that you save on fees as a market maker.

How to use it?

Let’s say you want to sell SFX at a higher price than what is currently being bid. After logging in to your Xcalibra account, choose the SFX/BTC market and go to the exchange page. Then, find the Limit order tab in the Sell section, set the price and amount, and click the Sell button.

After that, you will see a confirmation message on the screen, and after clicking CONFIRM your limit order will be placed on the order book.

You can see and manage your open orders on the right side of the screen in the section Orders. The limit order will only execute if the market price reaches your limit price. If the market price doesn’t reach the price you set, the limit order will remain open.

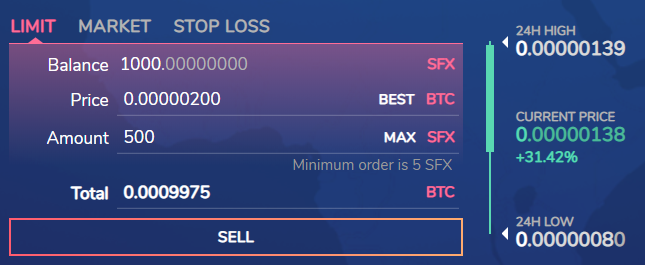

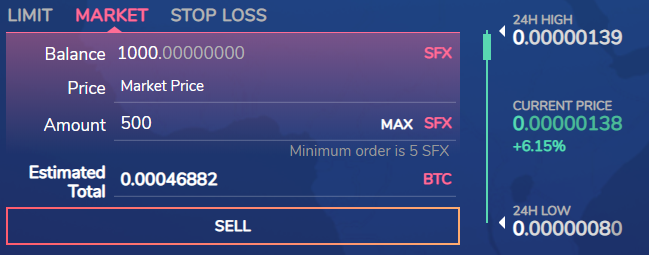

2. Market Sell Order

A market order is an order to quickly sell at the best available current price. It needs liquidity to be filled, meaning that it is executed based on the limit orders that were previously placed on the order book.

Unlike limit orders, where orders are placed on the order book, market orders are executed instantly at the current market price, meaning that you pay the fees as a market taker.

How to use it?

Let’s say you want to create a market order to sell 500 SFX. After logging in to your Xcalibra account, choose the SFX/BTC market and go to the exchange page. Then, find the Market order tab on the Sell side, set the amount to 500 SFT, and click the SELL button.

After that, you will see a confirmation message on the screen, and after clicking CONFIRM your market order will be executed.

Since market orders are executed right away, your market sell order will match the highest limit buy order available on the order book.

3. Stop Order Sell Order

Suppose you bought 100 SFX at a price of 0.023 BTC. It's now at 0.026 BTC. You've made some profit, but you're feeling good about SFX and think it has nowhere to go but up. At the same time, you're aware that crypto is volatile. How can you hold your SFX, but make sure you get out if a crash comes? Place a stop-order order with these parameters:

Stop: 0.024 BTC

Limit: 0.023 BTC

Amount: 100 SFX

Then click SELL in the stop-order box. A confirmation box will pop up telling you what will happen: "If the highest bid drops to or below 0.024 BTC, an order to sell 100 SFX at a price of 0.023 BTC will be placed."

You now have some protection. You are holding your SFX, but if the price crashes to 0.024 BTC, your SFX will automatically be sold - as long as there are enough buy orders at or above 0.023 BTC. As with a regular sell order, your coins will be sold at the best possible price; so if you want to be sure your coins get sold, set the limit price even lower.

Your limit price does not have to be lower than your stop. If you anticipate a dead cat bounce to 0.025 BTC after the crash to 0.024 BTC, you can set your stop at 0.024 BTC and your limit at 0.025 BTC. This will cause a sell order at 0.025 BTC to be placed should the highest bid drop to 0.024 BTC.